The Inflation Puzzle: Solving the Mystery of Rising Prices

- The New Gen

- Oct 14, 2023

- 7 min read

What is Inflation?

Inflation is a complex economic phenomenon that can have far-reaching effects on individuals, businesses, and nations. At its core, inflation is a gradual reduction in the purchasing power of capital, which leads to an overall increase in the prices of goods and services (“What is inflation?”) This can be caused by several factors, including changes in supply and demand, fluctuations in currency exchange rates, and government policies such as monetary and fiscal stimulus (Floyd). The impact of inflation on consumers can be significant, as it decreases their purchasing power. They may not be able to buy or use as many goods and services as they could before, which has a ripple effect on businesses. This can lead to a decrease in economic activity and, in some cases, a recession. The COVID-19 pandemic has caused a surge in inflation rates all over the world, leading to shortages of goods and services and a rise in consumer prices (Hausman). This has been exacerbated by the shift in consumer spending from services to goods, which has only added to the supply chain disruptions and price increases. The ongoing Russo-Ukrainian war has also had negative economic effects, both locally and globally (Caldara et al.). These events have made it more important than ever for consumers to educate themselves on the topic of inflation and take necessary measures to mitigate its impact on their standard of living.

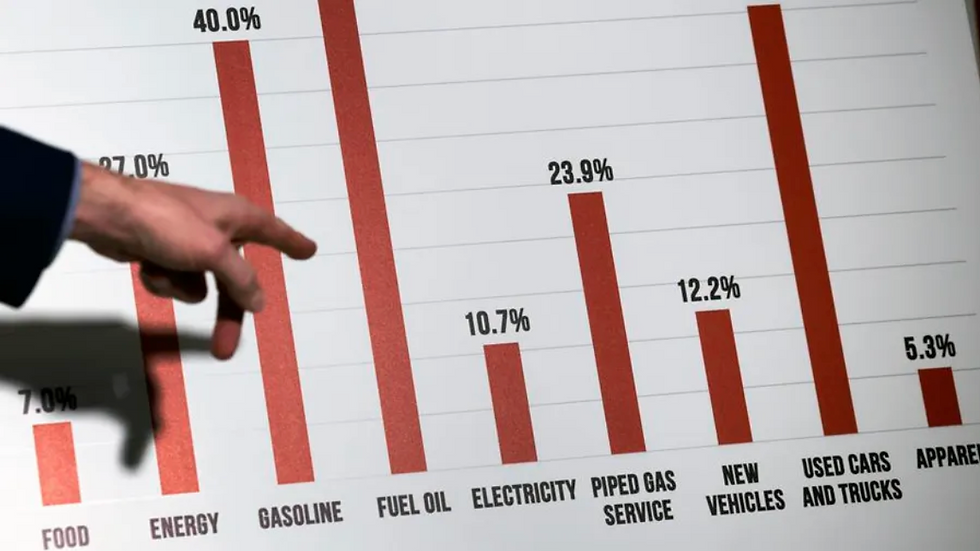

Figure 1.1 (Al Mallees)

Impacts of Inflation on Consumers:

Erodes Purchasing Power: The main impact of inflation is that it reduces the buying power of consumers, as the same amount of money can buy a decreasing amount of goods and services over time (Floyd).

Reduces Standard of Living: Consumers who have fixed incomes or limited savings may experience a decline in their standard of living due to inflation (Floyd).

Increases Cost of Borrowing: When there is inflation, borrowing may become more costly, resulting in higher fees for consumers who take out loans or use credit cards (“What is inflation?”)

Redistributes Wealth: Inflation has the potential to shift wealth from lenders to borrowers, as borrowers repay their loans with devalued dollars compared to when they initially borrowed the money (“What is inflation?”)

Increases Uncertainty: When inflation occurs, it can create uncertainty and difficulties for consumers who are trying to plan for the future. This is because they can't be certain about the future costs of goods and services (“What is inflation?”)

Impacts of Inflation on The Economy:

Reduces Economic Growth: The impact of inflation on the economy is evident as it can lead to decreased investment and productivity (Floyd).

Increases Interest Rates: When there is inflation, the interest rates may go up, resulting in a decrease in investments and borrowing (“What is inflation?”).

Reduces International Competitiveness: Inflation can decrease a country's global competitiveness by increasing the costs of its goods and services compared to other countries (Causes of inflation: Explainer: Education). For example, the graph below shows Japan having the lowest inflation rates in history compared to its competitors like the United States. Even though there was a slight increase in prices, it helped to enhance the competitiveness of Japanese exports (Pettinger). It's also worth noting that in the late 1970s, the UK had the highest inflation rates, impacting the competitiveness of British exports and leading to a decline in the manufacturing industry (Strachan).

Figure 1.2 (Pettinger)

Increases Unemployment: Inflation can cause unemployment to rise because it reduces investment and productivity. This can result in a decrease in demand for labour (Team).

Reduces Real Wages: Inflation can hurt real wages, which are wages that take inflation into account. This is because nominal wages may not increase at the same rate as rising prices (Team).

As we can see, inflation has a major impact on both consumers and the economy as a whole. It decreases the buying power of consumers, slows down economic growth, raises interest rates, and may cause higher unemployment rates and reduced international competitiveness. Policymakers must keep a close eye on inflation and take action to control it to maintain a steady and thriving economy.

Figure 1.3 (Williams)

What You Can Do to Avoid Heavy Impact:

There are several strategies that consumers can use to protect themselves from the effects of inflation. One of the most important is to invest in assets that are likely to appreciate over time, such as stocks, real estate, and precious metals (gold, silver etc.) Another strategy is to keep a close eye on inflation rates and adjust spending habits accordingly. One way to do this would be to use the Consumer Price Index (CPI), available on many websites, including Statistics Canada. The CPI is a metric that calculates the average fluctuation of prices paid by consumers for goods and services over time. It's commonly utilized as an indicator of inflation (O'Brien). For example, if inflation is high, consumers may want to focus on purchasing essential items and cutting back on discretionary spending (Gad). As a personal experience, my family and I observed a surge in gas prices and made a conscious effort to walk to places we frequently visit, such as the library or mall. We found ways to limit our driving as much as possible. This allowed us to save a substantial amount of money.

A Historical Perspective on the Role of Central Banks in Managing Inflation:

Throughout history, banks have employed various methods to control inflation. One such approach is monetary policies. Central banks utilize monetary policy and adjust interest rates to regulate economic fluctuation and price stability (Folger). In the 1960s and 70s, the US Federal Reserve adopted the "easy money" policy to encourage economic growth by keeping interest rates low (Bryan). Unfortunately, this strategy contributed to inflation rather than decreasing it (Bryan). To combat this, the Federal Reserve changed its approach to "tight money," which involved raising interest rates to limit money in circulation (Bryan). Although this policy was initially unpopular, it ultimately succeeded in curbing inflation and restoring economic confidence (Bryan).

Figure 1.4 (Bryan)

Another method of combating inflation used by banks is credit controls. Central banks sometimes use credit controls to control inflation. These controls typically involve regulations on lending activity and credit availability (Bryan). In 1971, the Bank of England introduced a policy called "Competition and Credit Control" (Read). The primary purpose of this policy was to reduce inflation and remove political influence from bank rate increases (Read). The policy replaced the previous system of limiting bank lending with tighter control of the money supply via increased interest rates (Read). However, when the bank attempted to raise interest rates during the reign of the Labour and Conservative governments, their proposals were rejected (Read). This contributed to Britain experiencing high inflation rates in the early 1970s and led to a crisis in the secondary banking sector that was only addressed in 1973-75 (Read).

Figure 1.5 (“Monetary Policy and Central Banking”)

Predicting and responding to economic changes is a challenge for central banks. The effectiveness of these measures can vary depending on the specific economic conditions and their ability to influence the economy. The ultimate goal is to maintain price stability and manage inflation through various monetary policy tools and strategies.

The Connection between Inflation and Economic Growth:

The connection between inflation and economic growth is a complex matter subject to debate in macroeconomics. As such, there are various theories and viewpoints concerning the relationship in question. On one hand, it can boost economic growth by spurring demand and promoting investments. On the other hand, it results in negative effects such as increased unemployment and decreased productivity. A boost in economic growth can result in more availability of goods and decrease inflation rates. However, over time, an increase in GDP can lead to inflation. If not managed properly, inflation can escalate into hyperinflation (Barnes). A classic and well-renowned example of this in history is the Weimar German Republic in 1921-1924. After World War I, Germany experienced significant economic and political turmoil. The Treaty of Versailles imposed reparations on Germany to compensate the victorious countries for the war's damage. To meet these obligations, the German government resorted to printing more money, resulting in hyperinflation (Backhouse). It's also worth noting that even though the COVID-19 pandemic primarily had negative impacts, including a global recession and decreased economic activity, it accelerated the adoption of digital technologies. Specifically, e-commerce allowed businesses to thrive when physical store locations were not operating. The chart below gives a general overview of the relationship between inflation and economic growth:

Figure 1.6 (Pettinger)

Overall, inflation is a significant economic concept that needs to be managed carefully to prevent any damage to the economy. It reduces people's purchasing power and leads to a decline in their standard of living. Fortunately, it can be managed through the implementation of fiscal and monetary policies, as well as by improving the availability of goods and services. It's crucial to safeguard oneself from the negative impacts of inflation during these times, which can be achieved by following the previously mentioned methods outlined in the article.

Works Cited:

Al Mallees, Nojoud. “Here’s How Inflation Works and What Can Be Done about Rising Prices | CBC News.” CBCnews, CBC/Radio Canada, 25 Feb. 2022, www.cbc.ca/news/business/inflation-business-explainer-1.6362093.

Backhouse, Fid. “Hyperinflation in the Weimar Republic.” Encyclopædia Britannica, Encyclopædia Britannica, Inc., 29 July 2023, www.britannica.com/event/hyperinflation-in-the-Weimar-Republic.

Barnes, Ryan. “The Importance of Inflation and GDP.” Investopedia, 5 Apr. 2023, www.investopedia.com/articles/06/gdpinflation.asp.

Bryan, Michael. “The Great Inflation.” Federal Reserve History, 22 Nov. 2013, www.federalreservehistory.org/essays/great-inflation.

Caldara, Dario, et al. “The Effect of the War in Ukraine on Global Activity and Inflation.” The Fed - The Effect of the War in Ukraine on Global Activity and Inflation, The Fed, 27 May 2022, www.federalreserve.gov/econres/notes/feds-notes/the-effect-of-the-war-in-ukraine-on-global-activity-and-inflation-20220527.html.

“Causes of Inflation: Explainer: Education.” Reserve Bank of Australia, scheme=AGLSTERMS.AglsAgent; corporateName=Reserve Bank of Australia, 4 May 2023, www.rba.gov.au/education/resources/explainers/causes-of-inflation.html.

Cheng, Ing-Haw. “Tuck Professor Explores Recent CBOE Volatility Index Trading Trends.” Tuck School of Business | What’s Happened to Volatility Trading?, 7 June 2018, www.tuck.dartmouth.edu/news/articles/whats-happened-to-volatility-trading.

Floyd, David. “10 Common Effects of Inflation.” Investopedia, 24 Apr. 2023, www.investopedia.com/articles/insights/122016/9-common-effects-inflation.asp.

Folger, Jean. “What Is the Relationship between Inflation and Interest Rates?” Investopedia, 24 May 2023, www.investopedia.com/ask/answers/12/inflation-interest-rate-relationship.asp.

Gad, Sham. “Timeless Ways to Protect Yourself from Inflation.” Investopedia, 19 Dec. 2022, www.investopedia.com/articles/basics/10/protect-yourself-from-inflation.asp.

Hausman, Josh. “Covid Has Broken the Economy.” The Atlantic, Atlantic Media Company, 13 Dec. 2021, www.theatlantic.com/ideas/archive/2021/12/pandemic-economy-inflation-causes/620931/.

“Historical Approaches to Monetary Policy.” Board of Governors of the Federal Reserve System, www.federalreserve.gov/monetarypolicy/historical-approaches-to-monetary-policy.htm.

“Monetary Policy and Central Banking.” IMF, 13 Jan. 2023, www.imf.org/en/About/Factsheets/Sheets/2023/monetary-policy-and-central-banking.

O’Brien, Megan. “The CFO’s Guide to Using Inflation Indicators for Business Planning: NetSuite.” Oracle NetSuite, 13 Feb. 2022, www.netsuite.com/portal/resource/articles/business-strategy/inflation-indicators.shtml.

Pettinger, Tejvan. “Conflict between Economic Growth and Inflation.” Economics Help, 15 Nov. 2017, www.economicshelp.org/blog/458/economics/conflict-between-economic-growth-and-inflation/.

Pettinger, Tejvan. “International Competitiveness.” Economics Help, 29 Jan. 2020, www.economicshelp.org/trade2/international_competitiveness/.

Read, Charles. “Reforming the Bank of England to Tame Inflation and Boost Financial Stability: Lessons from Two Centuries of British Financial History.” History & Policy, 21 Sept. 2022, www.historyandpolicy.org/policy-papers/papers/reforming-the-bank-of-england-to-tame-inflation-and-boost-financial-stability-lessons-from-two-centuries-of-british-financial-history.

Strachan, Ruth. “Who Killed British Manufacturing?” Investment Monitor, 24 Nov. 2020, www.investmentmonitor.ai/manufacturing/who-killed-british-manufacturing/.

Team, Investopedia. “What Causes Inflation?” Investopedia, 14 Mar. 2023, www.investopedia.com/ask/answers/111314/what-causes-inflation-and-does-anyone-gain-it.asp.

“What Is Inflation?” McKinsey & Company, 17 Aug. 2022, www.mckinsey.com/featured-insights/mckinsey-explainers/what-is-inflation.

Williams, Geoff. “Why Is Inflation Bad? 3 Effects of Inflation.” Forbes, Forbes Magazine, 29 July 2022, www.forbes.com/advisor/personal-finance/why-is-inflation-bad/.

Comments